- OGCI Climate Investments (CI) participated in recent $318 million funding round for breakthrough carbon capture and removal technology provider, Svante

- The funding round, largest for a point source carbon capture technology provider, values Svante over $1 billion, making it CIs second portfolio company with unicorn status

- CI initially invested in Svante in 2018, with additional investments in every following round

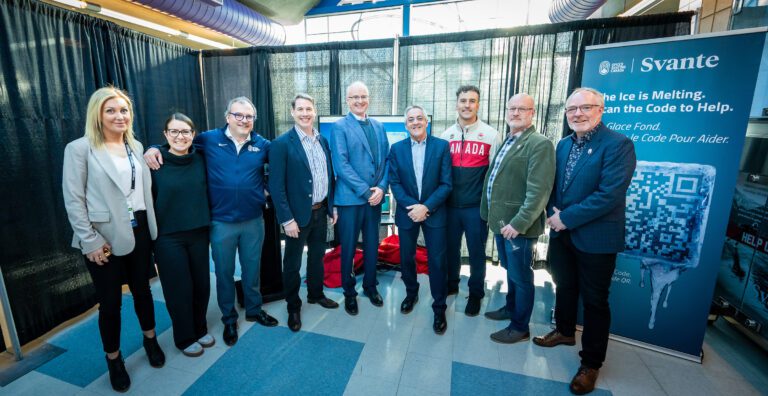

OGCI Climate Investments (CI), a specialist investor focused on capital- efficient decarbonization solutions, has made an additional investment in Svante, the developer of modular, scalable carbon capture and removal technology based on unique solid adsorbents. The investment formed part of Svante’s Series E fundraising round, which values the company over $1 billion, giving it unicorn status.

CI initially invested in Svante in 2018, with additional investments in every following round alongside new and existing investors. The latest funding round, led by existing shareholder Chevron, raised $318 million, making it the largest capital raise for a point source carbon capture technology provider.

Svante makes filters and rotary contactor machines that capture and remove carbon dioxide (CO2), a greenhouse gas, from industrial emissions and the air. The proven technology, available today, has the potential to significantly reduce the cost of carbon capture plant ownership, making it a promising solution for commercial scale industrial carbon capture, utilization, and storage (CCUS) projects across industries.